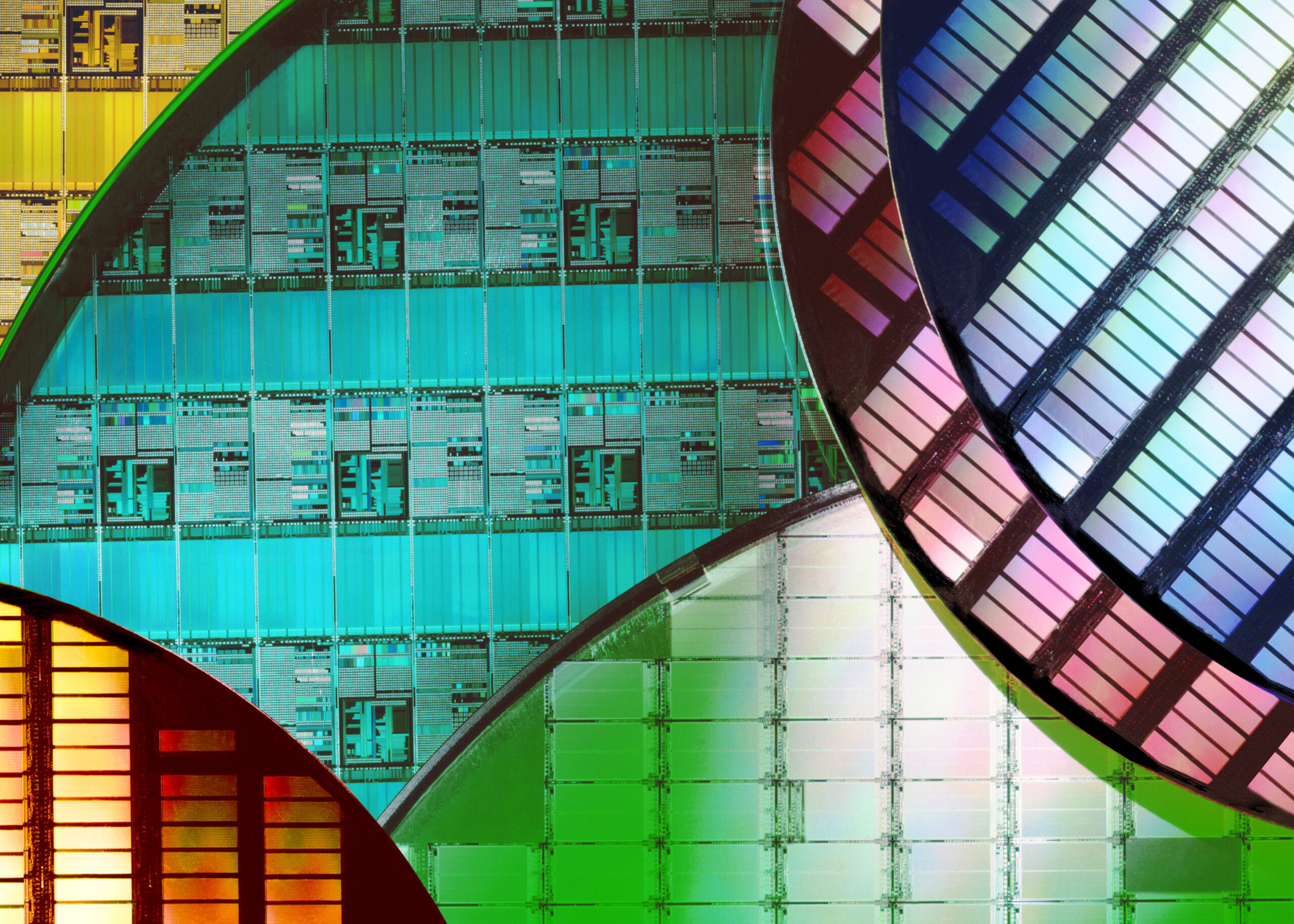

The U.S., Europe and Southeast Asia are expanding their fabrication capacity

According to a recent article published by Electronics360, companies in the U.S. and Europe are just now starting to get funding from the U.S. CHIPS Act and the Science Act and European Chips Act (ECA).

Collectively, these two funding packages have allocated $100 billion to support investment in new fabrication capacity, as well as research and development. More importantly, the public investment from the U.S. alone was the catalyst for additional private investment in the semiconductor industry that was nearly triple that of the CHIPS Act.

But the U.S. and Europe aren’t the only regions expanding their fabrication capacity. Southeast Asia is also growing its own semiconductor manufacturing, increasing the total wafer fabrication capacity coming online in the next few years.

Wafer capacity vs. number of fabs

Foundry capacity and number of foundry sites are two competing metrics which are not comparable. In terms of the number of facilities, the U.S. was solidly in the lead at the end of 2023. Throughout the U.S., there are 73 new semiconductor fabrication facilities that are planned for construction or are currently under construction, either as expansions of existing facilities or as brand-new facilities. In total, there are 50 brand new facilities being built by U.S. companies, and 42% of those brand-new facilities are in the U.S. But, according to the article, the most advanced foundry capacity will remain in Asia for the foreseeable future.

While U.S. foundry capacity may not be dominant, U.S. companies are still investing huge amounts of money in captive fabrication capacity, which is dedicated to a company’s own products. Whether these investments can return the U.S. to market dominance remains to be seen, but it advances U.S. independence from Southeast Asia.

Read the full article here.

Click here to learn more about Conax Technologies’ unique and innovative solutions for the semiconductor industry.